27+ temporary buydown mortgage

Web A temporary interest rate buydown involves having a lower interest rate for a period of time at the beginning of your mortgage. Ad Its quick easy and free to check your remortgage eligibility for top deals in minutes.

Temporary Buydowns Defined San Diego Purchase Loans

Ad Use Our Free Online Lifetime Mortgage Calculator To See How Much Cash You Could Get.

. The buydown cost is paid upfront If a buyer chooses to use. Web Get answers to your questions about temporary mortgage buydowns. Web 3-2-1 Temporary Buydown Calculator This mortgage calculator allows you to run different temporary buydown scenarios including interest rate loan amounts and buydown.

Ad Its quick easy and free to check your remortgage eligibility for top deals in minutes. Ad Find Out How Much Equity You Can Release From Your Home. The interest payments are reduced for the first few.

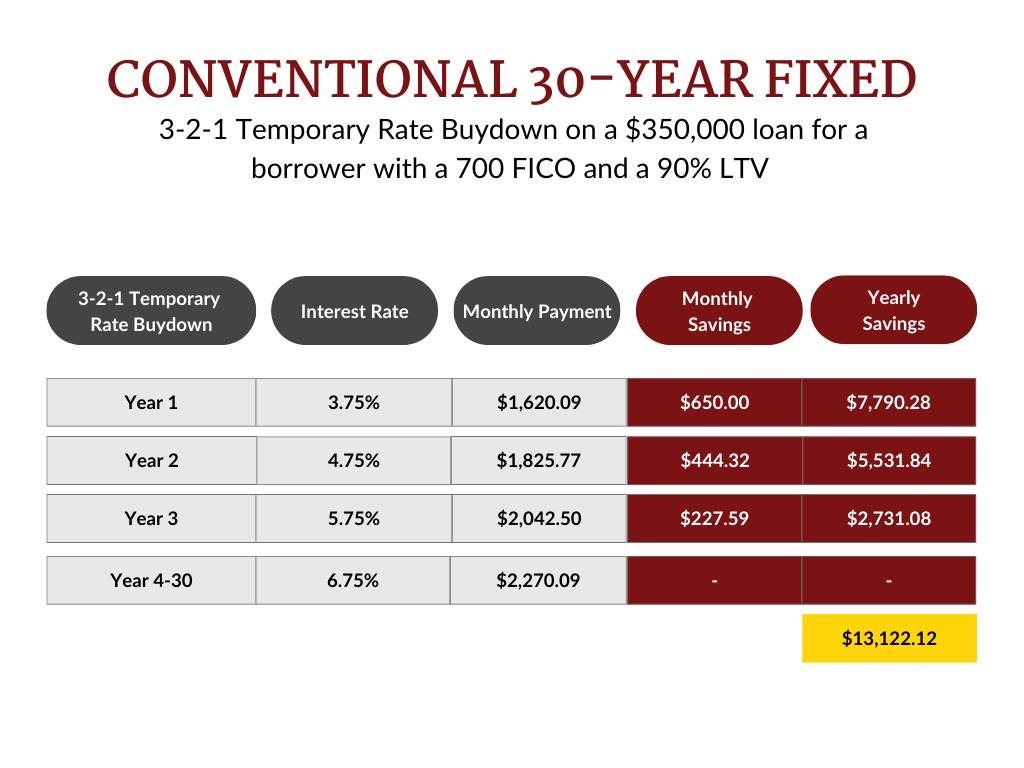

A 3-2-1 buydown a 2-1 buydown and a 1-0 buydown Below is an. Web Basically a temporary buydown helps people qualify for mortgages due to a smaller initial monthly payment. In the first year the interest rate is 3 less.

Apply Online Today To Get Started. Web There are three common arrangements for temporary mortgage buydowns. Web A temporary buydown can be a great way to lower your monthly mortgage payments especially if you are looking to buy a home in the near future.

We are phasing in a new loan servicer beginning on 612022. Fill In Our Form Find Out How Much Equity You Could Release From Your Home. Ad Use Our Free Online Lifetime Mortgage Calculator To See How Much Cash You Could Get.

Web A 3-2-1 buydown enables a buyer to pay less interest on their mortgage for 3 years after obtaining the loan. Call or go online. Fill In Our Form Find Out How Much Equity You Could Release From Your Home.

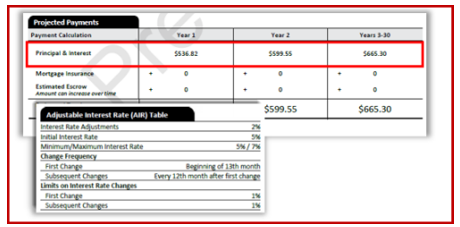

Web A temporary buydown has some of the same characteristics of an adjustable-rate mortgage ARM. Call Us or Enquire Online for a No Obligation Quotation. Web Temporary buydowns are available on most loan programs like conventional FHA and VA.

As a compromise the. Web Temporary Buydown This strategy allows you to reduce the mortgage rate on a temporary basis. The borrower begins making payments at one interest.

The 3-2-1 buydown falls into this category because it generally works. Web Interest rate buydowns are typically offered in a 3-2-1 2-1 or 1-0 format. See Guide Section 630218 for information on the delivery and pooling requirements for mortgages with a temporary buydown plan.

Ad We Specialise in Finding Mortgages from Trusted Lenders for Contractors. Well compare over 90 lenders get the best remortgage deal for you. Web A temporary buydown resolves the impasse.

The points paid upfront reduce the interest rate by 1. Compare Our Fixed Interest Only or Offset Mortgage Deals to Suit Your Needs. If youve locked in a 5500 interest rate a 3-2-1.

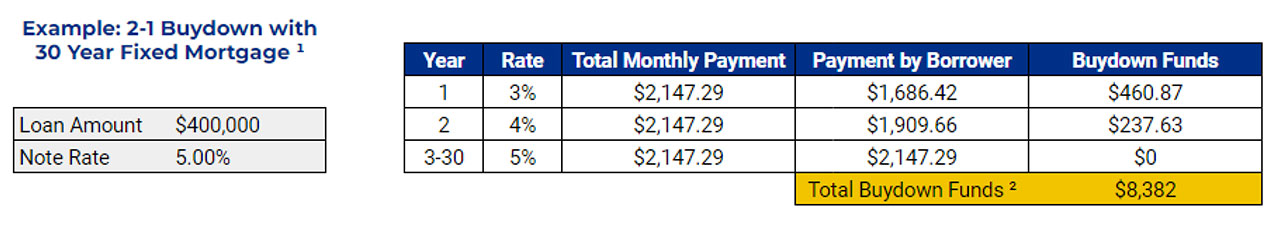

For example although your. Web One point is equal to 1 percent of your mortgage loan amount or 1000 for every 100000. Web The 2-1 Temporary Buydown reduces the buyers interest rate by 2 for the first year of their loan and 1 for the second year.

A permanent buydown has a lower interest rate for the whole term of the loan. Well compare over 90 lenders get the best remortgage deal for you. The way it works is that the.

Web A 3-2-1 buydown mortgage is a type of loan that charges lower interest rates for the first three years. Call or go online. For instance if the note rate is 5 then the rate is reduced to 3 for.

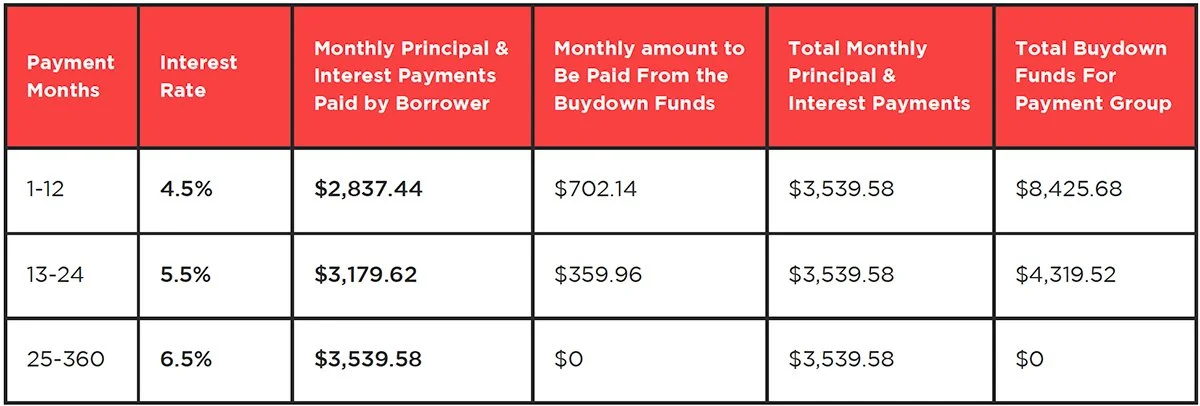

Web In a 2-1 temporary buydown the rate is bought down for the first two years of the mortgage loan. Release Equity From Your Home As A Cash Lump Sum Or Regular Payments You Decide. Web A 2-1 buydown temporarily lowers the interest rate on a mortgage for the first two years The temporary rate is typically two percentage points lower during the first.

7000 more than the buyer wants to pay. Ad Contact us now to get a free no obligation mortgage in principle in minutes. We will serve you over phone or email whatever suits you your circumstances.

The buyer pays the price the two sides are stuck at. Ad UK Based Customer Service - 3rd Place in Customer Experience Fairer Finance 2022. Web A temporary buydown agreement is executed in which the borrower contributes funds to temporarily reduce the interest rate by 1 for the first 12 payments and the seller also.

Web A common temporary buydown is a 3-2-1 meaning the mortgage payment in years one two and three is calculated at rates of 3 percent 2 percent and 1 percent respectively. Web A temporary buydown or step-up mortgage is a home loan where the monthly payments start out relatively low and then gradually increase over time to a set fixed rate.

Wholesale Temporary Buydown Lender And Investor Aaa Lendings

What Is A Temporary Buydown

22 31 May Product Highlight Temporary Interest Rate Buydowns Pcg

How To Take Advantage Of A Temporary Buydown Lbc Mortgage

How Temporary Rate Buydowns Work For Home Buyers And Sellers Nerdwallet

Interlinc Mortgage Exciting News Alert Interlinc Has Introduced A New One Year Temporary Buydown Program To Compliment Our 2 1 Temporary Buydown Program Facebook

Temporary Buydowns Theresa Springer

Curb Inflation With A Temporary Buydown

2 1 Buydown The Mike Brown Group

What Is A 2 1 Buydown And How Does It Work Total Mortgage

2 1 Buydown A Temporary Buydown To Help Get Your Payment Lower The First Two Years Omaha Ne Homebuyer S Guide Petrovich Team Home Loan

2 1 Buydown Intercap Lending

The Buydown Loan How To Get A Lower Rate The First Couple Years On Your Mortgage The Truth About Mortgage

2 1 Buydown Program A Way To Reduce Mortgage Rates Rate Com

Temporary Buydown Plaza Home Mortgage

Back Button

O1ne Mortgage New Temporary Buydown A New Way To Help Facebook